-Complete user

database with encrypted passwording and

user access control.

-Will

effectively manage any number of

vehicles.

-Data

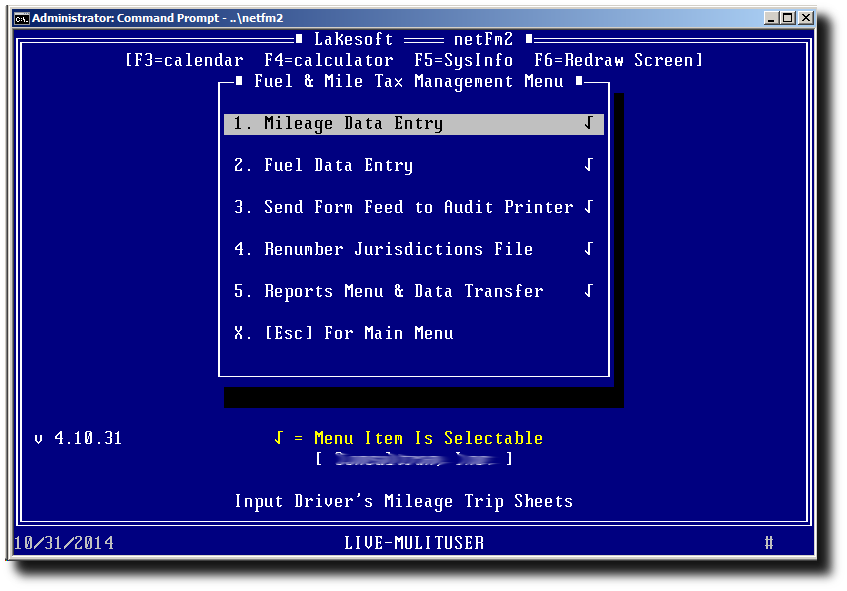

entry is accomplished using the 10-key,

not a mouse.

-Multi-User

(commercial version) Single-User (small

fleet owner)

-Can

export data to 'flat files' for use in

other systems.

|

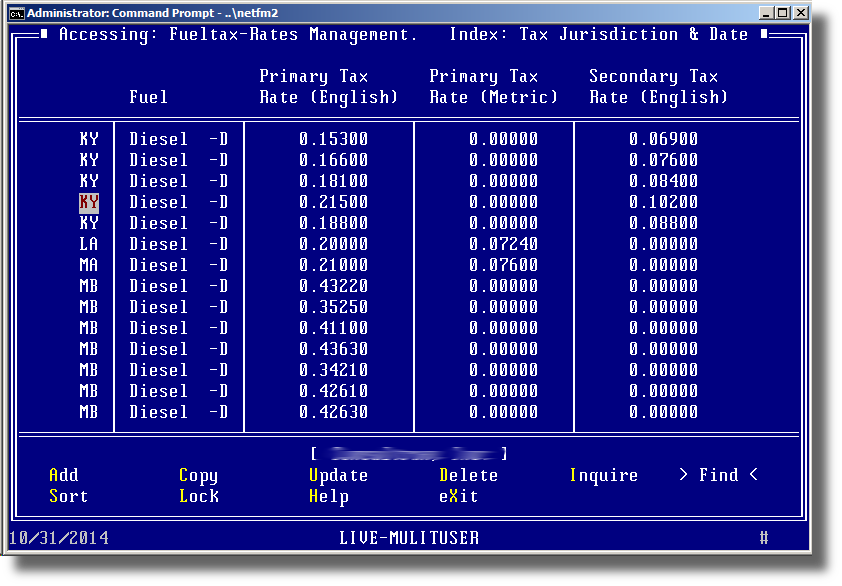

-Tax calculations are based

upon rate effective dates.

-FM2

can calculate taxes for multiple fuels

and vehicle types.

-FM2

does not require tax matrix updates

nor does it discard quarter tax rates.

-Tax

rate tables are access protected

preventing unauthorized edits.

-FM2

allows for the attachment of late and

penalty fees for final IFTA output. |